The order to cash process (also known as O2C or OTC) is the process every customer order progresses through. It refers to an order’s journey from the moment it’s placed through to the day you receive payment from the customer.

This process is key to your business’ success, as the experience your customers have placing and receiving orders can affect the relationship they have with your business. So here’s what you need to know about the stages of the O2C process, and how to optimise it.

The Order to Cash Process in 4 Simple Steps

Step #1: A Customer Places an Order

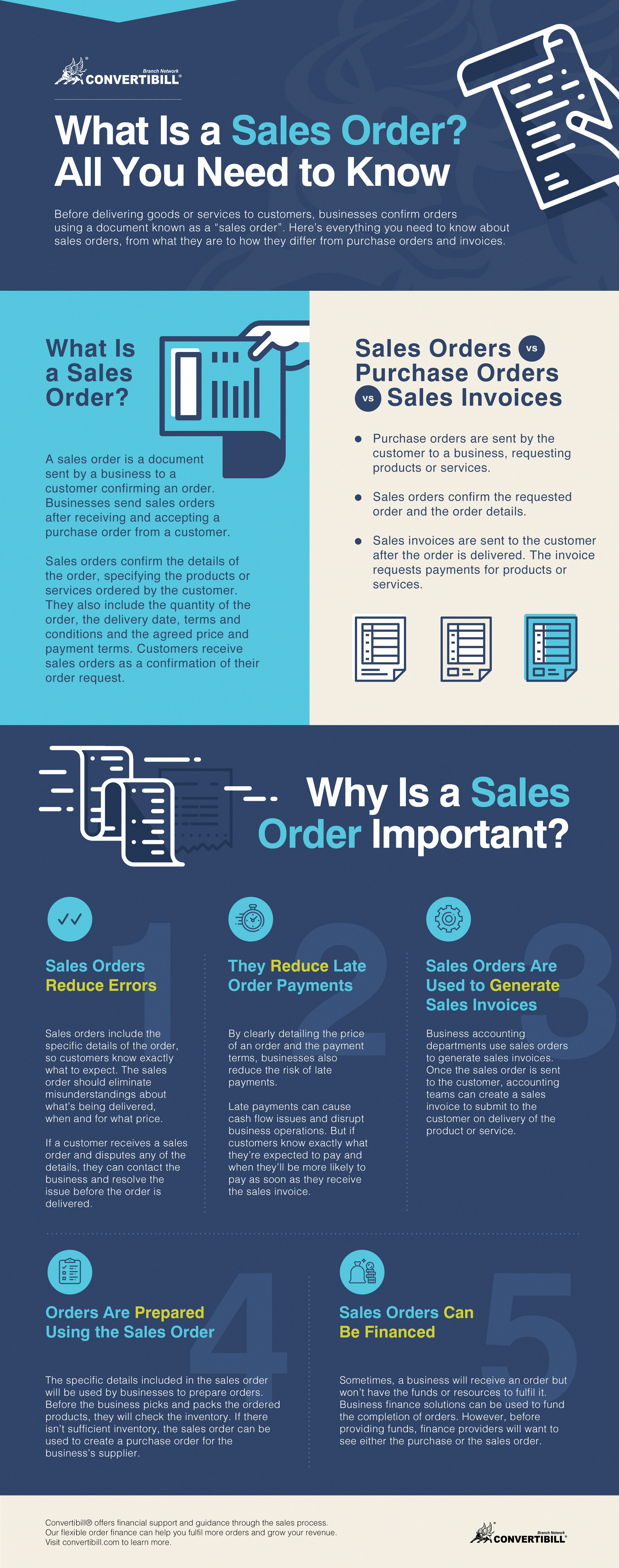

When a customer places an order with you, this starts the order to cash process. The customer sends a purchase order, which should detail the type of product they’re ordering, the quantity, the price and the delivery details.

Step #2: The Business Fulfils the Order

Once you’ve received and accepted the purchase order, you’ll send a sales order to the customer. A sales order is similar to the purchase order and contains much of the same information. However, it’s a confirmation of the order rather than a request.

You can then fulfil the order, by manufacturing or purchasing stock, or carrying out a service. You should aim to complete the order as soon as possible after receiving the purchase order. This prevents delivery delays and customer complaints. Once the order is ready, you can deliver it to the customer.

Step #3: The Customer Receives the Invoice

Once your customer has received their order, you send them an invoice (if they didn’t pay when they placed the order). The invoice will request payment, so you should send this right after the customer has received their order — or even when the order is delivered. The sooner invoices are submitted, the sooner customers can pay — and fast-paying customers prevent cash flow issues from arising.

Step #4: The Customer Pays the Invoice

The last stage of the O2C process is customer payment. Reliable customers should pay invoices soon — if not immediately — after receipt. Once you’ve received payment, you should record this in your business’ general ledger.

How to Optimise the Order to Cash Process

Optimising your order to cash process can improve your business’ cash flow and the efficiency of your operations. So here are some of the ways you can improve the O2C stages.

Identify the Troublesome Stage

Businesses often find it’s a certain stage of the O2C process that holds them up financially. So if you’re experiencing delays at a certain point in the process, it’s a good idea to identify the stage causing the trouble. Then you can work on improving that stage to optimise the process.

Consider Using Business Finance to Fund Stages of the O2C Process

If parts of the O2C process are being held up because of your business’ cash flow, a business finance solution can help speed things along.

For example, if you receive a large order but don’t have the funds to cover the order costs, purchase order finance allows you to take on orders of all sizes. Or invoice finance can relieve the financial strain of late-paying customers.

Offer Multiple Payment Options

Many businesses experience most of their O2C issues in the last step: receiving payment from the customer. There are a few reasons why customers make late payments. Two of the most common reasons are:

#1: The customer has a lot of invoices to pay and yours has become buried in their “to do” list. In this case, a friendly follow up email or letter can remind them.

#2: The customer is experiencing financial difficulty or cash flow issues, in which case offering multiple payment options could be the perfect solution.

More payment solutions can make it more convenient for your customers to make a payment. One payment option you could consider is customer finance. By allowing your customers to pay in monthly instalments, payments become more affordable — so customers are more likely to pay on time. Just because your customers spread their payments, doesn’t mean you’ll receive fragmented payment. You can work with a finance provider who will pay you the full amount upfront, while they collect the instalments.

Convertibill can help you create a smooth and efficient order to cash process. With our finance solutions, cash flow won’t stand between you and your customers. Contact us today to find out more about how we can help.

Τέσσερα

Τέσσερα